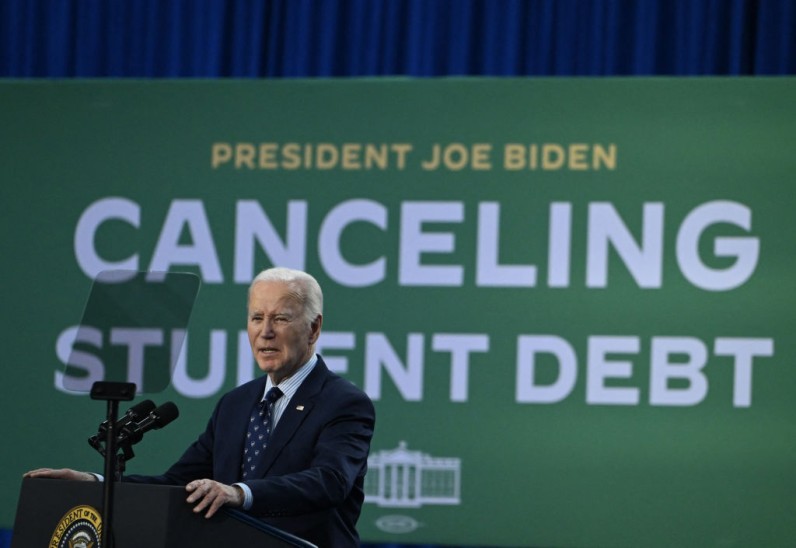

President Joe Biden's recent proposal for student loan cancellation is making progress as a proposed regulation, providing him with a new opportunity to fulfill a campaign pledge and engage young voters before the November election.

The Education Department submitted the necessary paperwork for a new regulation that aligns with the student loan forgiveness announced by Biden last week. The process is not yet complete as it requires a 30-day public comment period and another review before reaching its final stage.

25 Million Borrowers Could Soon Have Their Student Loan Debt Relieved

This proposal is more focused than the one that was invalidated by the US Supreme Court last year. The new plan utilizes an alternative legal foundation and aims to eliminate or decrease loans for over 25 million individuals in the United States.

Opponents with conservative views argue that the policy places an unjust financial burden on taxpayers who did not pursue higher education, and they have expressed their intention to contest it through legal means.

The plan was emphasized by the Democratic president during a recent visit to Wisconsin, with the president expressing that it would bring about significant relief. He outlined five different groups of individuals who would qualify for assistance.

If approved, the new student loan relief plan proposed by the administration has the potential to eliminate the outstanding balances of numerous student loan borrowers. Here's a list of potential beneficiaries, according to CNET:

- Individuals who have accumulated substantial loan balances as a result of interest may have the opportunity to have up to $20,000 of their interest balances forgiven.

- Individuals who are part of an income-driven repayment plan and have an annual income below $120,000 ($240,000 for married couples filing jointly) may be eligible for automatic forgiveness of the total amount their balance has increased due to interest.

- Individuals who started repaying their federal student loans 20 years ago may be eligible to have their remaining debt forgiven.

- Individuals with federal student loans who meet the criteria for loan forgiveness through programs such as SAVE, Public Service Loan Forgiveness, or Teacher Loan Forgiveness may have their loan balances eliminated, regardless of whether they have enrolled in the qualifying programs.

- Certain individuals who have faced financial difficulties or attended a school that no longer receives federal funding may be eligible for assistance. A new rule is being drafted by the administration to assist borrowers who may be experiencing financial difficulties in the upcoming months.

How to Apply for Biden's Student Loan Forgiveness 2024?

One of the proposed rules addresses the issue of borrowers who find themselves with more debt now than when they initially borrowed, primarily due to accumulating interest.

The proposed measure would enable the Education Department to automatically eliminate a maximum of $20,000 in debt for borrowers, specifically targeting the portion of their outstanding balance that surpasses the original amount they owed at the beginning of their loan repayment.

This policy would have a broad impact, covering various types of student loans held by the Education Department, such as parent loans, consolidated loans, and those in default.

Under a new rule, the Education Department would have the authority to completely eliminate the debt that borrowers accumulated while enrolled in Income-Driven Repayment plans.

For eligibility, borrowers must have an annual income of $120,000 or less if single and $240,000 or less if married.

According to the Biden administration, a staggering number of borrowers currently find themselves in a situation where they owe more than their initial loan amount, all thanks to the interest on federal student loans.

The new regulations would eliminate the entire growth in balances for nearly 25 million borrowers. The Education Department has also unveiled a draft of a rule that addresses the cancellation of debt for borrowers who have diligently made payments for 20 or more years.

This policy is applicable to undergraduates who initiated loan repayments prior to July 1, 2005. Graduate school borrowers have the opportunity to have their debt canceled once they have repaid their loans for a period of 25 years, starting from July 1, 2000.

The administration has projected that approximately 2.6 million borrowers who still have outstanding debt on old loans in repayment would be affected by this one-time move.

However, officials are seeking input from the public regarding potential solutions to assist borrowers who are near, but not quite meeting, the necessary timeline requirements.

Additional regulations have been implemented to address the issue of debt cancellation for eligible borrowers who have not yet applied due to various challenges such as paperwork requirements, inadequate guidance, or other barriers.

In the coming months, the Education Department plans to release a second rule that aims to offer assistance to borrowers facing financial difficulties.

This week's developments bring the Biden administration one step closer to potentially alleviating the burden of debt for millions of people.

President Biden's efforts to cancel debt have faced criticism from some quarters, with opponents arguing that it unfairly impacts Americans who did not take out loans, attend college, or have already repaid their debts.

Republicans have strongly criticized the effort, arguing that it merely shifts the debt rather than actually eliminating it. They are concerned that these efforts could contribute to driving up the national debt, especially with less money coming in.

However, the move received praise from some advocates on Tuesday. The Center for Responsible Lending has strongly supported the idea of eliminating accrued interest, according to Daily Mail.

Join the Conversation