The Biden administration revealed its plan to use existing student loan forgiveness programs to provide relief for an additional 277,000 borrowers, amounting to a total of $7.4 billion in canceled student debt.

During President Joe Biden's tenure, the Department of Education has implemented policies that streamline the student loan forgiveness process for certain borrower groups, such as public sector workers. Additionally, a new repayment plan has been introduced, offering a more expedited route to student loan forgiveness for numerous low-income borrowers.

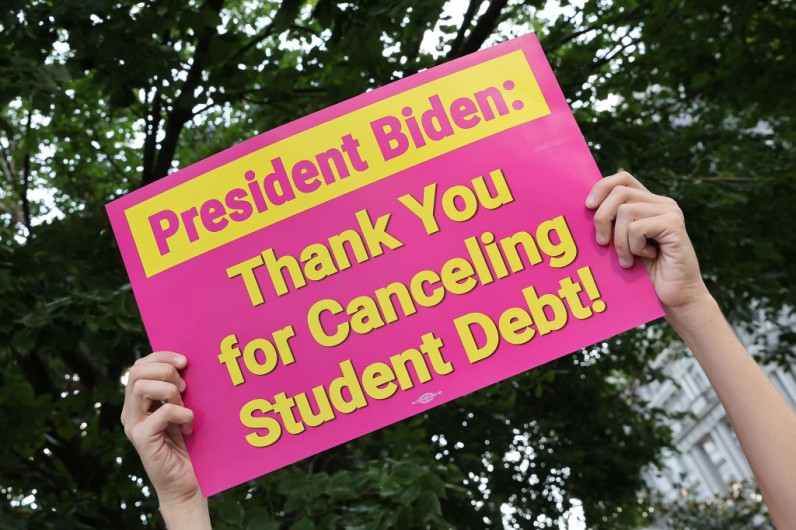

Biden Cancels $7.4 Billion in Student Loan Debt

"Today's announcement shows -once again-that the Biden-Harris Administration is not letting up its efforts to give hardworking Americans some breathing room," stated Secretary of Education Miguel Cardona.

According to Forbes, the student loan forgiveness announcement comes after a previous round of accelerated forgiveness approvals under SAVE in February and is distinct from Biden's unveiling a new comprehensive student loan forgiveness plan earlier this week.

Overall, the Biden administration has approved the forgiveness of $153 billion in student loan debt for approximately 4.3 million individuals. This accounts for over 9% of the total federal student loan debt that is currently outstanding.

With the November election on the horizon, the Biden administration has been actively highlighting its efforts in canceling student loan debt. They have been consistently making announcements about debt relief, approximately once a month, and reaching out to eligible borrowers through email.

Earlier this week, Biden unveiled a fresh set of student debt relief proposals that may potentially be implemented this fall.

Many Republicans have strongly criticized Biden's student loan forgiveness efforts, claiming that the president is shifting the burden onto taxpayers who did not attend college or have already paid for their education.

According to critics, he is bypassing the Supreme Court, which invalidated Biden's prominent student loan forgiveness program in the previous year.

Over the past few weeks, the Biden administration has faced legal challenges from two groups of Republican-led states regarding the income-driven repayment plan implemented last year. The plan, known as SAVE (Saving on a Valuable Education), provides highly favorable terms for borrowers with low incomes.

A significant portion of the student debt relief, totaling around $3.6 billion, will be allocated to individuals who are currently enrolled in the SAVE plan, CNN reported.

Republicans in 18 states are seeking to hinder their constituents from accessing the benefits of the SAVE plan. According to White House press secretary Karine Jean-Pierre, they are aiming to terminate SAVE, increase their constituents' payments, and burden them with never-ending loan debt," she stated during a call with reporters on Thursday.

READ NEXT : Russia Destroys Ukraine's Largest Power Plant After Launching Widespread Attacks on Energy Grid

Who's Eligible For Biden's Latest Student Loan Forgiveness?

The White House has announced that the latest round of debt relief will benefit three specific groups of people.

A total of $3.6 billion has been allocated to support the 206,800 borrowers who are currently enrolled in the SAVE plan.

A significant amount of debt, totaling approximately $3.6 billion, is set to be forgiven for nearly 207,000 borrowers who have enrolled in the Saving on a Valuable Education (SAVE) plan. This program, an income-driven repayment (IDR) initiative, was established by the Biden administration in the previous year.

According to the White House, individuals who are having their debt canceled through SAVE had borrowed smaller amounts for their college education.

Under the plan, individuals can qualify for loan forgiveness after making a minimum of 10 years of payments, provided they initially borrowed $12,000 or less for their college education.

For borrowers with larger loan amounts, eligibility for forgiveness is extended to 20 or 25 years, depending on the specific types of loans they have.

A staggering $3.5 billion has been allocated to assist a significant number of 65,700 borrowers who are currently enrolled in income-repayment plans.

These borrowers will be granted forgiveness through "administrative adjustments" to repayment plans, addressing the challenges faced by some borrowers in qualifying for relief.

A total of $300 million has been allocated to assist 4,600 borrowers through the Public Service Loan Forgiveness (PSLF) program.

The PSLF program aims to assist individuals in public service professions, such as teachers and government employees, in obtaining debt forgiveness after a decade of repayment.

Meanwhile, the program faced significant challenges due to its complex rules, making it difficult for individuals to have their debt canceled. Prior to the Biden administration, only 7,000 people were able to receive student loan forgiveness.

In the most recent wave of forgiveness, the Biden administration has approved the cancellation of $62.8 billion in loans for 876,000 borrowers through PSLF.

In two separate lawsuits, attorneys general from 18 states, who are aligned with the Republican party, are seeking to have the SAVE plan invalidated and to put a stop to any additional student debt cancellation.

Critics argue that the SAVE plan exceeds Biden's authority and poses challenges for states in their efforts to attract employees. They argue that the plan undermines a separate cancellation program that promotes careers in public service.

The implications for loans that have already been canceled remain uncertain. A court document filed by the attorney general of Kansas suggests that it is highly unlikely for any loan forgiveness to be recovered during this litigation, according to CBS News.

Join the Conversation