In a major policy shift, the Trump administration has ordered mortgage giants Fannie Mae and Freddie Mac to begin recognizing cryptocurrency as a valid asset in mortgage loan applications.

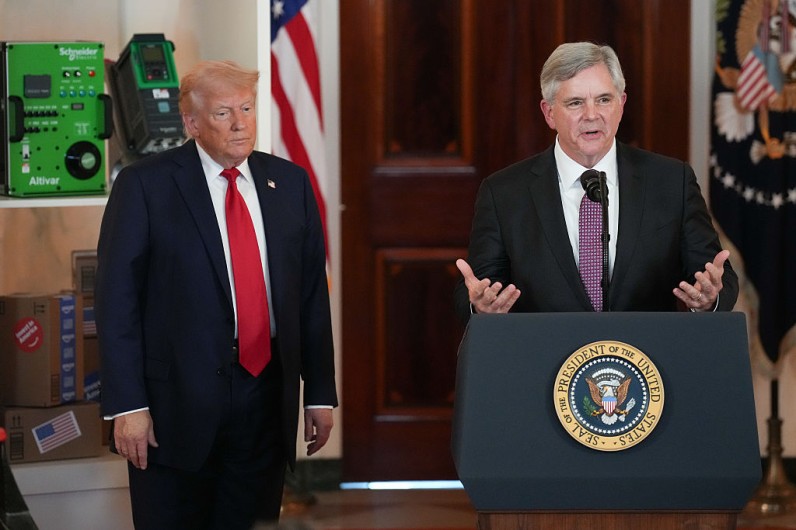

The directive, signed Wednesday by Federal Housing Finance Agency (FHFA) Director William J. Pulte, marks the first time crypto has been formally acknowledged in US housing finance.

Under the new order, Fannie Mae and Freddie Mac must develop proposals that include digital currencies in their risk assessments for single-family home loans, NBC News said.

Homebuyers will no longer need to convert their crypto holdings into US dollars before applying for a mortgage — a rule that has previously shut out crypto-wealthy buyers from traditional home financing.

"After significant studying, and in keeping with President Trump's vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage," Pulte said in a statement on X.

The policy reverses a previous stance under the Biden administration, which had barred crypto-related income from mortgage applications, citing market instability.

The new directive aims to bring crypto further into the US financial mainstream, especially as digital assets gain popularity in household portfolios.

🇺🇸IT’S OFFICIAL: CRYPTO TO COUNT FOR REAL ESTATE MORTGAGES

— Coin Bureau (@coinbureau) June 26, 2025

“In line with President Trump’s vision to make the U.S. the crypto capital of the world, I’ve directed Fannie Mae & Freddie Mac to begin treating crypto as an asset for mortgage qualification.” - Bill Pulte pic.twitter.com/cIOkVjJ7Hx

Crypto Gets Housing Boost in New Trump Policy Shift

To manage risks, the FHFA's order restricts qualifying crypto to assets held on US-regulated centralized exchanges.

Proposals from Fannie Mae and Freddie Mac must also include safeguards to address crypto's price swings, such as adjustment models and asset weighting systems.

Bitcoin and other cryptocurrencies remain highly volatile — in February, Bitcoin dropped 16% in just one week.

The FHFA acknowledges the risk but also sees potential in crypto as a long-term wealth-building tool for Americans. Though still rare in real estate, crypto's role is slowly growing.

According to FinancilaExpress, a recent survey by the National Association of Realtors found only 1% of buyers used digital currency for down payments between July 2023 and June 2024. But this new policy could change that.

Fannie Mae and Freddie Mac, which back more than half of all US home loans, are still under federal control following the 2008 housing crisis.

Trump has hinted at possibly taking them public again, and this new directive could be a step toward broader financial reform.

Both institutions must now draft proposals and submit them to their boards and the FHFA for approval. The timeline remains open, but Pulte urged quick action: "as soon as reasonably practical."

Join the Conversation