The Department of Education has recently announced that there has been an increase in federal student loan interest rates for the upcoming 2024-2025 school year. The new rate stands at 6.53 percent, which is higher than the previous year's rate of 5.5 percent.

According to higher education expert Mark Kantrowitz, the current undergraduate interest rate is at its highest point in the past ten years, as reported by CNBC.

Read also: SNAP Benefits 2024: Storm-Affected Residents to Receive Replacement Applications, Extended Deadline

Student Loan Interest Rates Hit Over 10 Years High

Undergraduate loan interest rates have not reached such heights since the 2012-13 school year.

Graduate students will experience an increase in the interest rate for the upcoming academic year, with the rate rising to 8.08% from the previous rate of 7.05%.

In addition to being available to both parents and graduate students, PLUS loans will now come with a 9.08% interest rate, which is an increase from the previous rate of 8.05%.

The rates for graduate students and parents have reached a historic low, not seen since before July 2006, when the government implemented fixed rates for student loans. In the past, the majority of federal student loans had fluctuating interest rates.

The increase in student loan interest rates will result in higher costs for borrowers when repaying their debt.

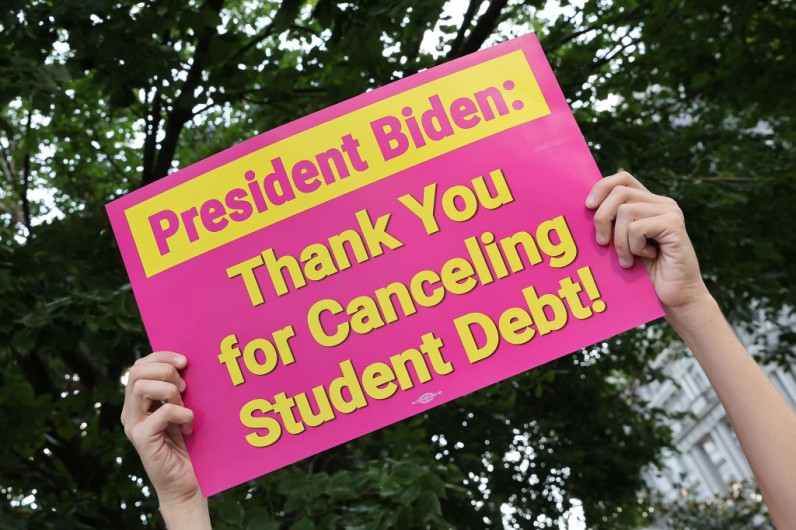

This could potentially pose a challenge for President Joe Biden, who is striving to gain support from young voters leading up to the November election.

Rise in Student Loan Interest Rate is Expected

The rates are determined each year and are influenced by the outcome of the 10-year Treasury note auction that takes place in May.

The rise in interest rates was somewhat expected, given the Federal Reserve's decision to maintain the country's benchmark rate at a 23-year high while waiting for inflation to subside.

The Biden administration has already taken significant steps to address the issue of federal student loan debt, surpassing the amount canceled by any previous administration at nearly $160 billion.

However, while debt relief is beneficial for college graduates, it does not directly address the underlying problem of the high cost of education for current and future students.

However, Biden's recently proposed student loan repayment plan, called SAVE (Saving on a Valuable Education), has the potential to alleviate the burden of federal student loan debt for both current and future borrowers, even in light of the interest rate increase, according to Investopedia.

Join the Conversation