The Biden administration has introduced the Saving on Valuable Education (SAVE) plan, a fresh Income-Driven Repayment (IDR) initiative designed to alleviate the financial strain of student loan repayment for individuals with lower and moderate incomes.

This plan has the potential to significantly decrease the monthly payments for numerous borrowers and provide a faster path to loan forgiveness.

Employment Eligibility for Student Loan Forgiveness

The borrower's occupation can also be a factor in qualifying for student loan forgiveness, often in combination with the duration of repayment.

Individuals working for nonprofit or government organizations may be eligible for Public Service Loan Forgiveness.

According to Forbes, the PSLF program offers the opportunity for loan forgiveness after making 120 qualifying payments, which is equivalent to a decade of payments.

The Biden administration has introduced two important "waivers" that have provided temporary relief and expanded access to debt relief.

These include the Limited PSLF Waiver and the IDR Account Adjustment. In the future, PSLF will be implementing stricter rules.

However, there are some new opportunities for loan forgiveness under the program, specifically for religious workers, adjunct faculty, and certain contractors.

In addition, the Teacher Loan Forgiveness program offers a potential debt relief of up to $17,500 for educators who meet the program's rigorous criteria and teach at a qualifying Title I institution for a minimum of five years.

Federal Perkins loans are also eligible for cancellation based on specific professions.

However, for the majority of borrowers dealing with significant federal student debt burdens, PSLF is often the more advantageous program to pursue.

Student Loan Forgiveness Summer Applications

For borrowers who apply throughout the summer, their applications will be processed in a timely manner to ensure that payments can resume in the fall, once the federal payment freeze ends.

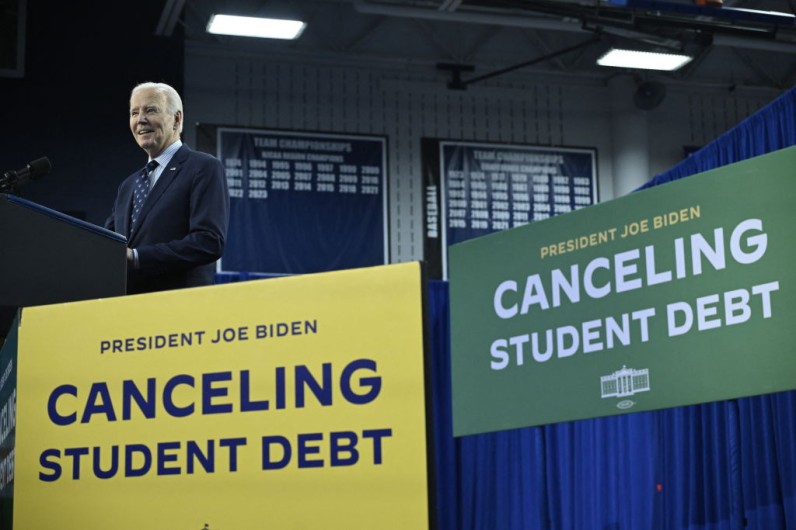

This development follows the Supreme Court's rejection of President Biden's one-time debt relief program, which sought to provide forgiveness to eligible borrowers.

According to Marca, the Biden administration has formed a Student Loan Relief Committee to investigate different options for alleviating student debt.

While the details of any potential forgiveness program are still unclear, the administration has made a commitment to giving priority to providing relief for borrowers who are facing financial difficulties.

Join the Conversation