First Brands, a major US auto parts company, is facing more trouble as its founder and CEO Patrick James officially stepped down Monday.

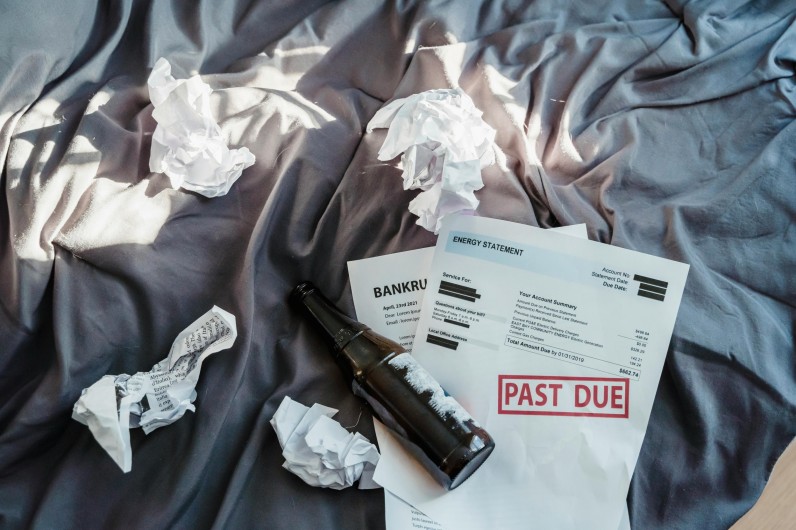

His resignation comes just weeks after the company filed for bankruptcy and revealed that over $2 billion in funds are unaccounted for.

Charles Moore, who joined as Chief Restructuring Officer in September, has been named interim CEO.

He will now lead efforts to stabilize the company and guide it through the ongoing bankruptcy process, which began on September 29.

First Brands, known for popular products like Fram filters and Autolite spark plugs, was once a fast-growing company.

It changed its name from Crowne Group about five years ago and took on large debts to buy smaller auto parts makers. But that aggressive expansion strategy may have caused its downfall.

According to AP News, bankruptcy filings show the company owes between $10 billion and $50 billion, while holding less than $10 billion in assets.

The missing funds have alarmed investors and lenders, especially after attorneys for the company told the court: "There's $12 million in the bank account today. There is nothing else."

Patrick James steps down as First Brands CEO

— junkbondinvestor (@junkbondinvest) October 13, 2025

One of the more elusive CEOs in credit markets. Built a multi-billion dollar empire while maintaining no public presence. Couldn’t even find a photo of him online.

Impressive, suspicious, or both? pic.twitter.com/oUDCAR7xVZ

Court Urged to Appoint Examiner in First Brands Case

Raistone Capital, one of the affected lenders, has asked the court to appoint an independent examiner.

In its emergency motion, Raistone said that up to $2.3 billion has "simply vanished" and questioned whether the company's own board could be trusted to investigate.

Financial firm Jefferies is among the most exposed. Through its partner, Point Bonita, Jefferies had a factoring deal with First Brands—meaning it advanced money based on the company's unpaid invoices from big clients like Walmart and AutoZone.

Jefferies is now trying to recover $715 million from that deal, Reuters said.

Jefferies leaders said in a letter Sunday that First Brands stopped sending payments on September 15.

They also stated their direct exposure is limited to $43 million and believe the panic over their involvement is overblown.

Still, trust in First Brands has been shaken. The court has approved the release of $500 million from a $1.1 billion emergency loan to keep operations running and pay workers and suppliers.

The next bankruptcy hearing is set for October 29.

Join the Conversation