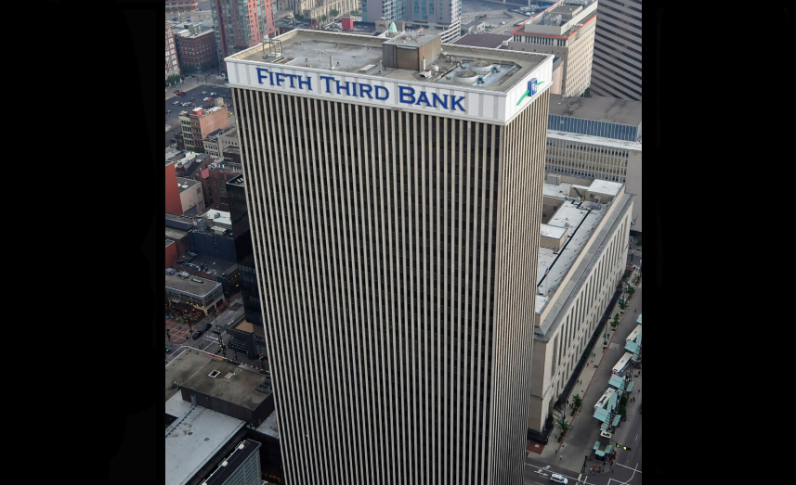

Fifth Third Bank announced it will acquire Comerica in an all-stock deal worth $10.9 billion, a move that will create the ninth-largest US bank by assets.

The merger is expected to close in the first quarter of 2026, pending regulatory approval.

This major deal will increase Fifth Third's total assets to $288 billion, while also expanding its presence across 17 of the 20 fastest-growing US markets, including key regions in the Southeast, Texas, Arizona, and California.

"This combination marks a pivotal moment for Fifth Third as we accelerate our strategy to build density in high-growth markets and deepen our commercial capabilities," said Fifth Third CEO Tim Spence.

Under the agreement, Comerica shareholders will receive 1.8663 Fifth Third shares for each share they own, valuing Comerica stock at $82.88 per share based on Fifth Third's closing price on October 3, CNN reported.

Once the deal is finalized, Fifth Third shareholders will hold 73% of the new company, while Comerica shareholders will hold 27%. Comerica's operations will be rebranded under the Fifth Third name following the merger.

Fifth Third currently operates nearly 1,100 branches in 12 states and employs around 19,000 people nationwide.

Fifth Third Bancorp agreed to purchase Comerica for about $10.9 billion in stock, in a deal that will create the ninth-largest bank in the country.

— Bloomberg TV (@BloombergTV) October 6, 2025

Herman Chan of Bloomberg Intelligence has the details https://t.co/Sm4uLzQyiv pic.twitter.com/ej16BfjVM3

Fifth Third Targets $850M in Savings from Comerica Merger

According to USA Today, Comerica, which began in Detroit in 1849 and is now based in Dallas, brings over 350 additional branches and about 7,500 employees to the table.

Fifth Third also plans to expand Comerica's 108-branch network in Texas, aiming to add 150 more locations in the state by 2029.

The merger will also make Fifth Third the top bank in Detroit, a city where it currently has a limited footprint.

While growth is a key goal, some branch closures and corporate job cuts are expected, with the bank targeting $850 million in cost savings from the integration. Details on which locations will close have not yet been shared.

Comerica CEO Curt Farmer will become vice chair of the new company, and Chief Banking Officer Peter Sefzik will lead the combined firm's wealth and asset management division.

The new entity is expected to have two major fee-based businesses generating over $1 billion each year — Commercial Payments and Wealth & Asset Management.

The deal comes as regional banks seek to recover from 2023's banking crisis and prepare for lighter regulations under the Trump administration.

Join the Conversation