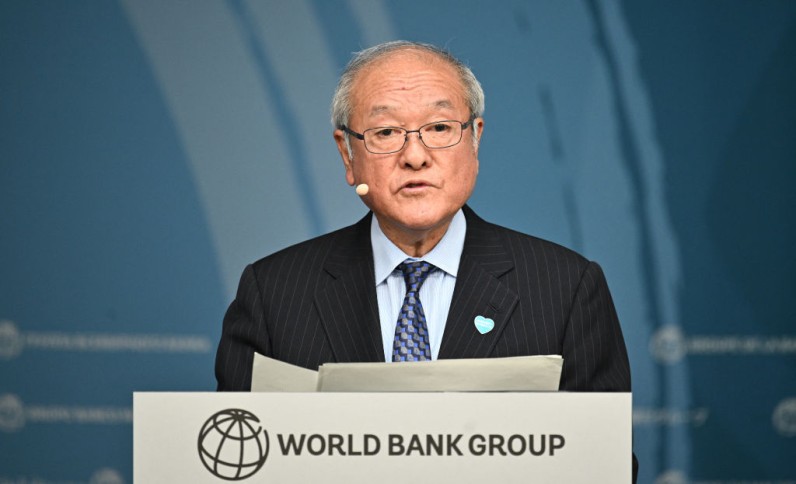

Japanese Finance Minister Shunichi Suzuki stated in a press conference Tuesday (May 14) the importance of coordination and collaboration between the Japanese government, currently ruled by the Liberal Democratic Party (LDP), and the Bank of Japan (BOJ).

Bloomberg reported that the statement was made to ensure both institutions would not undermine each other in identifying and completing their policy objectives.

Suzuki's remarks responded to rising speculations in the Japanese market that a weak yen might prompt the BOJ to increase its interest rate after a previous increase last March.

Noticeably, low interest rates in Japan are one of the key driving factors behind the yen's weakness.

Last week, BOJ governor Kazuo Ueda told lawmakers that he has been watching the yen's recent trends, saying that "abrupt and one-sided weak yen moves" raise uncertainties and would negatively and undesirably affect the Japanese economy.

In response, Suzuki said that he was well aware of Ueda's yen reference, adding that the government would "closely communicate" with the BOJ to ensure that no friction would be produced in the process.

On the other hand, Suzuki declined to comment on specific moves regarding yields on Japanese government bonds, saying that they were "determined by the market based on various factors."

Japanese sovereign bond yields surged on Tuesday to their highest levels in over a decade despite signs that the central bank was ready to reduce its debt prices to ease the pressure on the yen. The day before (Monday, May 13), the bank made a surprise move of cutting the amount of its bond-buying after the yen was valued at 160 per US dollar late last month.

The last time the yen was bolstered similarly was in 1990. Meanwhile, US Treasury Secretary Janet Yellen cautioned about currency manipulation, saying that government and central banks' intervention should only occur rarely and should be communicated to trade partners.

The yen has been valued at 156.40 per dollar as of press time.

Join the Conversation